capital gains tax increase effective date

The House bill would apply the increase to gain recognized after September 13 2021. Double the capital gains rate to 408 percent and the imposition of a second death tax by imposing capital gains taxes on unrealized assets at death.

How To Calculate Capital Gains Tax H R Block

Currently has a combined capital gains rate of over 29 percent inclusive of the 38 percent Obamacare tax and the 54 percent state average capital gains rate.

. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income rates with 37. The Presidents plan you may recall would make the increased capital gains rate effective after April 2021. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987 and by 40 in 2012 in anticipation of the increased maximum tax rate from 15 to 25 in 2013.

The 1987 capital gains tax collections were slightly below 1985. It is possible that Democrats after eliminating the filibuster quickly coalesce around a proposal to repeal the TCJA provisions and provide for some limited increase in personal income and capital gains rates effective retroactively in 2021 and then leave larger reforms for another tax bill to become effective in 2022. Dems eye pre-emptive capital gains effective date.

If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act. The effective date for this increase would be September 13 2021. More than five months ago.

On Friday May 28 2021 the Biden Administration released its Green Book setting out the Presidents revenue and policy proposals. The proposed effective date for a 25 percent capital gain rate is September 13 2021. The table also shows the inclusion Eligible.

An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate. With tax writers launching mark-ups as early as Sept. We are the American Institute of CPAs the worlds largest member association representing the accounting profession.

Retroactive effective date for capital gains tax increase is a bad idea. The proposed legislative text currently provides that any transactions completed on or before September 13 2021 or subject to a binding written contract on or before September 13 2021 even if the transaction closes after September 13 are subject to the current 20 percent. It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced with little to no advance warning.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. The current estimate of that effective date ranges from October 15 2021 on the early. 9 and racing against a Sept.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. The effective date for this increase would be september 13 2021.

Faq on capital gains outlook and effective date. 27 deadline there could be imminent action triggering an effective date tied to an upcoming date. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced.

The maximum rate on long-term capital gains was again increased in 2013. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the potential top marginal tax rate on capital gains if the inclusion rate increases to 66 2 3 or 75.

13 2021 unless pursuant to a written binding contract effective on or before Sept. The proposal would increase the maximum stated capital gain rate from 20 to 25. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in.

If a capital gains tax increase is enacted advisors will encourage many clients to try and sell assets as soon as they can. Today youll find our 431000 members in 130 countries and territories representing many areas of practice including business and industry public practice government education and consulting. Of particular interest to investors is the administrations proposal to raise the tax on long-term capital gains from its current maximum rate of 238 percent including the 38 percent net investment income tax to a new rate of 408.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of. That reference is to April 28 2021 when the proposal was announced in President Bidens address. The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept.

Our history of serving the public interest stretches back to 1887. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. 174 billion tax increase The US.

A notable exception being the taxation at ordinary rates for long term capital gains and qualified dividends for taxpayers with incomes in excess of 1 million this change will become effective after the date of announcement according to the Treasury Budget. This resulted in a 60 increase in the capital gains tax collected in 1986.

2022 And 2021 Capital Gains Tax Rates Smartasset

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Estimated Tax Penalties For Home Resales

Tax Advantages For Donor Advised Funds Nptrust

Harpta Maui Real Estate Real Estate Marketing Maui

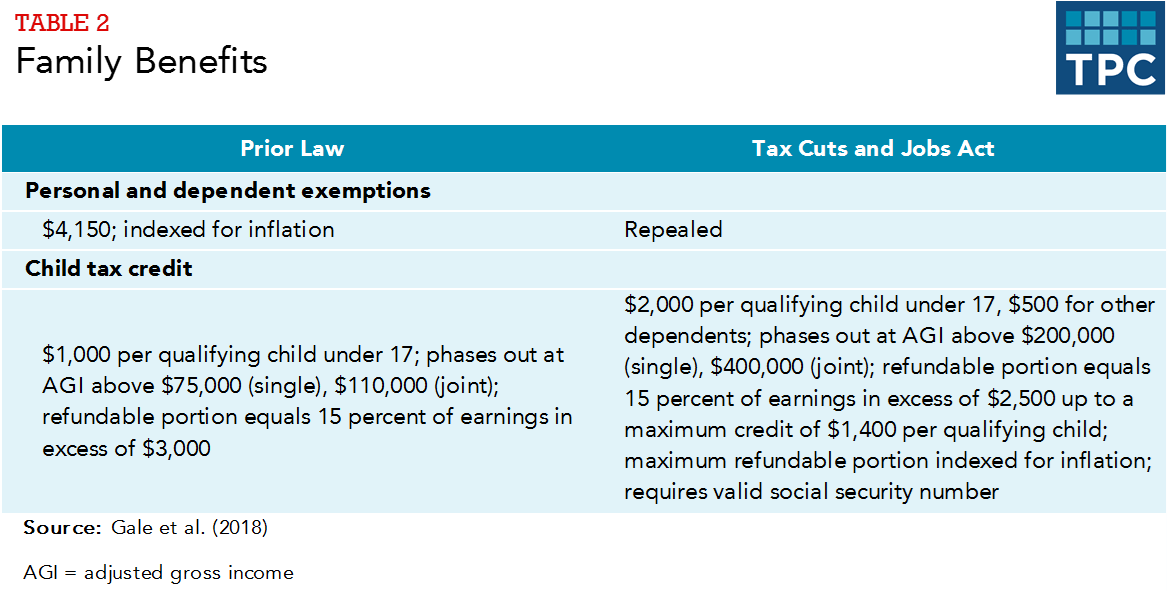

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Capital Gains Tax What Is It When Do You Pay It

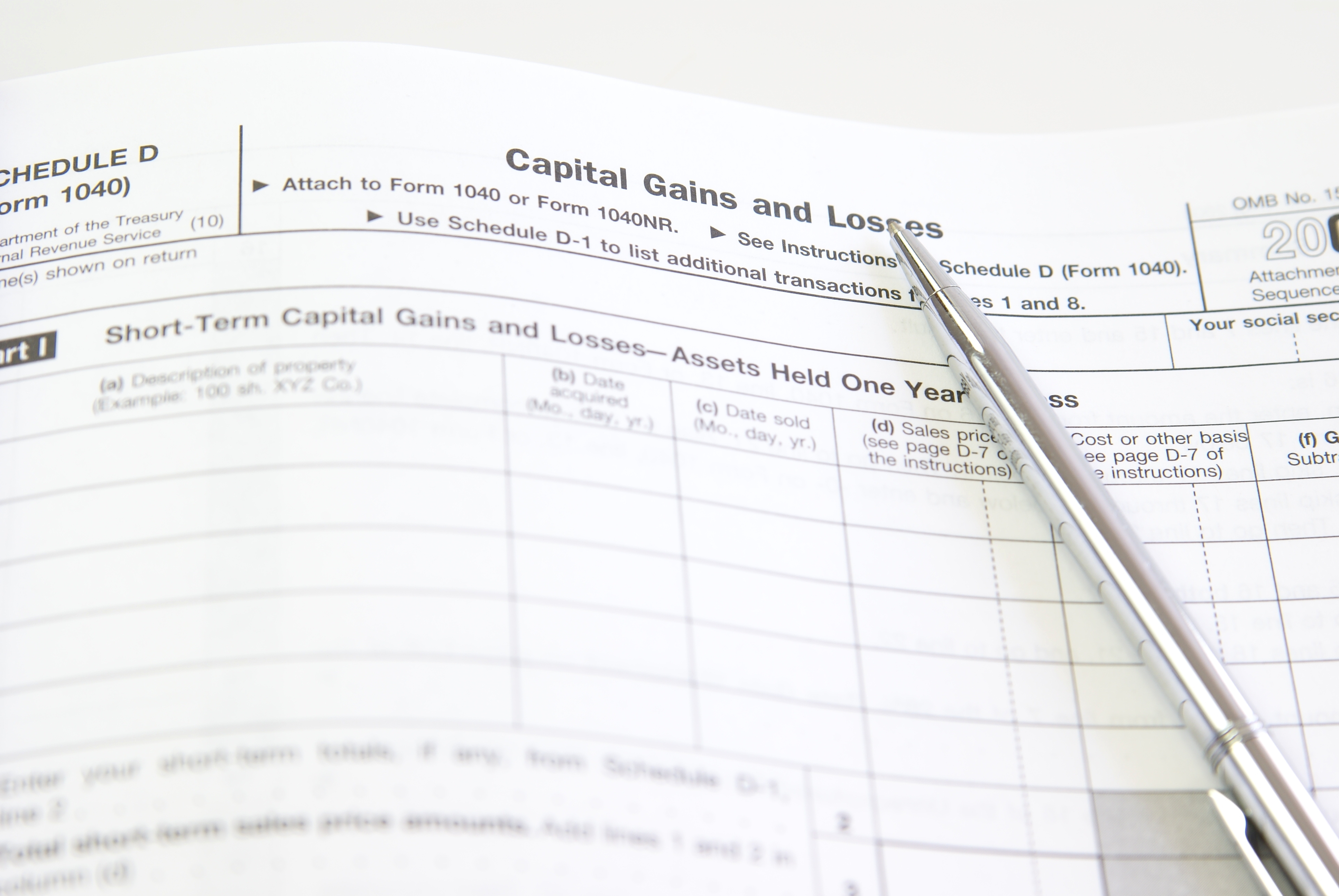

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

How To Open Capital Gains Account In India In 2022

How Capital Gains Affect Your Taxes H R Block

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Capital Gains Tax What Is It When Do You Pay It

2022 And 2021 Capital Gains Tax Rates Smartasset

Capital Gains 101 A Simple Guide To Understanding A Complicated Tax Code Mint Com Blog Capital Gain Career Motivation Coding

Capital Gains Definition 2021 Tax Rates And Examples

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It